Traditional Market Analysis in FMGC: Key Data and Major Consulting Firms

The Fast-Moving Consumer Goods (FMCG) sector is one of the most competitive and dynamic globally, driven by constantly evolving consumer preferences, the emergence of new competitors and technological advancements. In this context, companies need accurate and up-to-date information to make rigorous and strategic decisions. Market reports have become a key tool for achieving this, allowing companies to better understand market trends, analyse their competitors and adapt their marketing and sales strategies.

This article explores the types of essential datasets for understanding this market, their application in traditional market reports and how these tools serve as a basis for business decisions. We will also consider the role of new digital tools as discussed in a second article.

Essential datasets for understanding the market

For a comprehensive understanding of the FMCG market, companies rely on several key types of data. There are 4 fundamental data sources within this environment. Each one has its own particularities and different applications:

Sales data

Provides information on the volume and value of products sold at different points of sale. This data is essential for understanding market demand, brand performance and consumer preferences. Within sales data, there are also 3 different types of datasets:

- EPoS data (Electronic Point of Sale) provided by intermediary entities such as IRI or Nielsen, which collect, organise and distribute large volumes of data, extracted from cooperative retailers who provide it to them.

- Direct data provided by retailers through their own platforms, such as Walmart’s Retail Link portal or Amazon Retail Analytics (ARA) data.

- Hybrid data, a mix between information obtained from EPoS and direct data from retailers.

Consumer data

This data is obtained through surveys, consumer panels or tracking online behaviour. It provides information on consumer preferences, habits and attitudes, allowing companies to better segment their target market and adapt their strategies.

Consumer panel data, such as that provided by Nielsen, IRI or Kantar Worldpanel, is also useful for understanding buyer demographics. Some specific types of panel methodologies in ecommerce include tracking electronic receipts, such as that offered by Rakuten Intelligence and Edison Trends, and browser monitoring, offered by providers such as Hitwise and Similarweb.

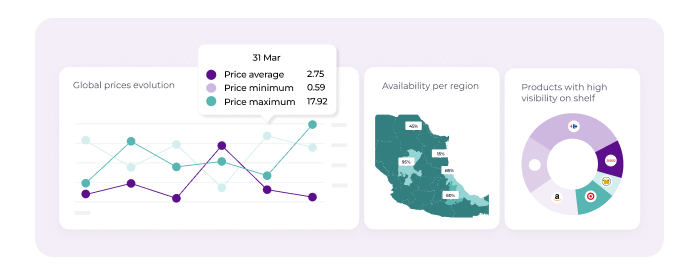

Digital Shelf data

Digital Shelf data helps brands and manufacturers monitor and manage their presence on digital shelves, ensuring compliance with their specifications and the integrity of their content and pricing policies and promotions across all retailers with online as the source.

External and macroeconomic market data

External factors such as inflation, government statistics, competitor behaviour and market evolution directly influence product performance. For a well-informed strategy, companies must consider these factors that affect consumer purchasing power and the prices of basic products.

Important characteristics for evaluating the quality of a dataset

When selecting a dataset for market analysis in FMCG, it is important to consider various characteristics that can affect its usefulness and accuracy. Some of the most relevant are:

- Geographic coverage: It is essential that the data reflects the market in the geographic areas relevant to the business, as consumer preferences can vary significantly between regions or countries.

- Update frequency: In a market as dynamic as FMCG, having up-to-date data is key to being able to react in time to changes in the competition or in consumer behaviour.

- Accuracy and reliability: Data quality is crucial. Poorly structured or incomplete datasets can lead to wrong decisions. It is important that data sources are reliable and verify the quality of the information they collect.

- Data depth: The data must be detailed enough to provide useful insights. For example, it is not enough to know the total sales of a product; it is also necessary to understand who buys it, why they prefer it and how they behave compared to the competition.

- Compatibility with other data sources: The ability to integrate data from different sources is essential to obtain a complete view of the market. Data that cannot be combined with other sources limits analytical capacity and decision-making.

Traditional Market Reports in Fast-Moving Consumer Goods

Market reports, historically developed by large consultancies such as Nielsen, Kantar and others, have formed the basis for companies making strategic decisions. These sources offer a detailed analysis of product performance, market share and consumer trends.

Main features of traditional reports

- Robustness and methodological rigour: With years of experience in data collection, these agencies offer rigorous and exhaustive data. The methodologies they apply conform to international standards, ensuring very high quality and accuracy.

- Historical coverage: Historical data is essential for forecasting and long-term trend analysis. Companies can observe seasonal consumption patterns, variations in demand and anticipate changes in the market.

- Comparability: Since these consultancies work with standardized methodologies, it is easy to compare data regionally or globally, which facilitates decision-making in companies with operations in multiple markets.

Uses and limitations

- High cost: One of the main drawbacks of traditional market reports is their high cost. For small and medium-sized enterprises, this type of report may be inaccessible due to its price.

- Response time: Traditional reports are usually updated quarterly or annually, which limits the ability of companies to react quickly to changes in the market.

- Aggregated data: Often, these reports provide aggregated data that may not be detailed enough for certain niche strategies. For example, granular information on specific consumer segments or new emerging brands may be missing.

Traditional reports are useful for understanding the situation in a less granular context and long-term trends. However, they present limitations in terms of adaptability and accessibility for growing businesses.

With the emergence of digital market analysis tools, many organisations supplement traditional report data with that offered by digital platforms. In the following article, we explore how tools like flipflow offer innovative solutions to transform how FMCG companies access real-time data and optimise their strategies.