Exploring the Future of Retail Media: Trends and Challenges

It began as a relatively straightforward concept—displaying ads on retailer websites—but has evolved to such an extent that Retail Media is expected to reach €31 billion of investment in Europe by 2028. It has become a multifaceted ecosystem integrating technological advancements, data strategies and a fiercely customer-centric approach.

The importance of Retail Media lies in its ability to offer brands access to highly segmented audiences in an ideal purchasing context. By leveraging first-party data, retailers can help advertisers target consumers with precise messaging, improving conversion rates and maximizing return on investment. This approach not only benefits brands but also generates new revenue streams for retailers, allowing them to monetise their platforms in innovative ways.

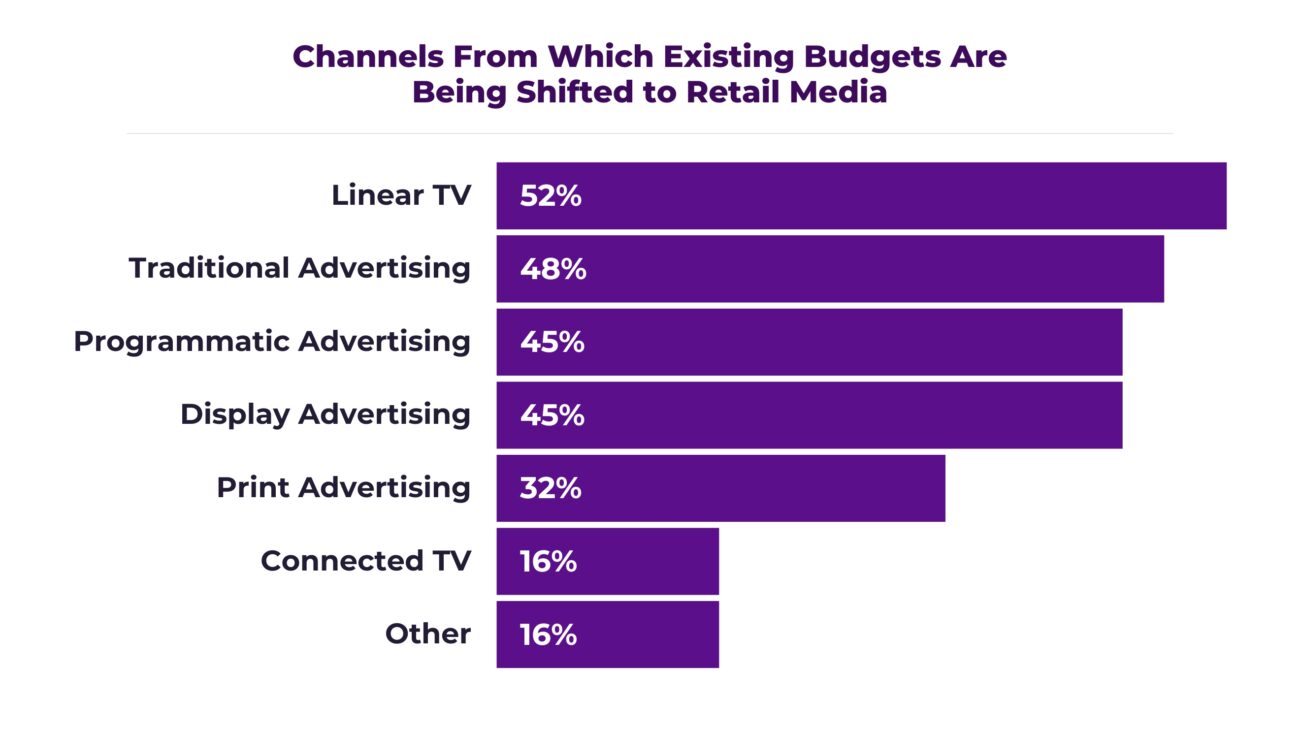

As brands shift budgets from traditional media (such as print or linear TV) towards data-driven Retail Media Networks, it’s increasingly clear that this environment is becoming an integral part of advertisers’ strategies.

Source: IAB Europe Retail Media Key Stats, October 2024

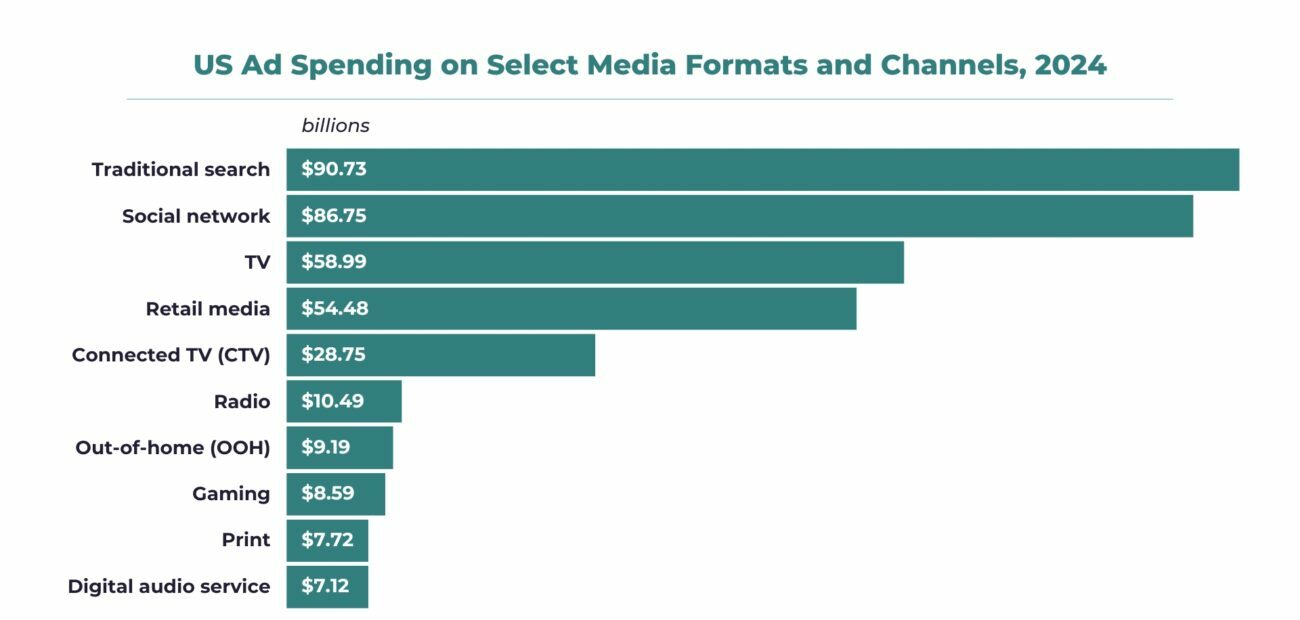

In the words of Yara Daher, Retail Media consultant for IAB Europe, “Retail Media and Connected TV (CTV) are the two fastest-growing channels, experiencing remarkable growth rates of 17% and 16.2% respectively. A significant part of CTV’s success is due to Retail Media data. These two dynamic channels are deeply interconnected, and understanding one is essential to understanding the other”.

In this article, we aim to delve into the emerging trends in Retail Media, the most promising advertising formats and the opportunities that will define the future of the sector.

Expanding Horizons: Beyond the Web and Endemic Brands

Traditionally, Retail Media has focused on connecting endemic brands with consumers within e-commerce platforms. Endemic brands are those that have a direct and natural relationship with the environment in which they advertise, because their products or services are aligned with the purpose or function of the platform or channel where they are promoted. In the case of Retail Media, endemic brands are those that sell their products directly through the retailer that offers advertising space. For example, a food brand advertising on a supermarket website.

These brands tend to benefit from greater relevance in advertising because they are present in a context where consumers already have a related purchase intent. However, this view is changing as retailers and advertisers explore new expansion opportunities.

Inclusion of non-endemic brands

One notable shift we are seeing is the incorporation of non-endemic brands into the Retail Media ecosystem. These brands do not sell their products directly through the retailer, but they can leverage the targeted audiences of these platforms for their campaigns.

For example, a car manufacturer might advertise on a retail site to promote its electric vehicle line, knowing that its target audience is also purchasing items related to sustainability.

Beyond e-commerce, from online to offline

Retail Media is no longer confined to the digital environment. Retailers are bringing advertising strategies into physical stores using tools such as digital signage, interactive screens and kiosks with real-time targeting capabilities. This omnichannel approach seeks to maximize touchpoints with the consumer, creating cohesive experiences that increase loyalty and sales.

What is Driving Demand for Retail Media Strategies?

The meteoric rise of Retail Media is explained by a convergence of factors that are reshaping the global advertising landscape. Let’s look at the main drivers of this trend:

The rise of e-commerce

The growth of e-commerce has transformed how consumers buy products, with platforms such as Amazon, Walmart and Alibaba leading the charge. These platforms don’t just act as points of sale; they also offer high-value advertising spaces, as they capture users at the moment of highest purchase intent. Their effectiveness in the buyer’s decision-making process is pushing brands to invest more in these types of strategies.

Digitisation as a key driver for generating business for retailers

To maintain their competitive advantage, retailers are significantly increasing their investments in technology, advanced data analytics and digitisation processes. These initiatives not only improve the shopping experience by making it more seamless and connected, but they also position Retail Media as a strategic extension of their core operations.

Through digitisation, they have the ability to map and analyze in detail the entire customer journey, allowing them to identify crucial moments where they can integrate relevant advertising. This optimizes the effectiveness of ads by presenting them in the right context, increasing the likelihood of interaction and conversion.

The first-party data revolution for targeted advertising

With the phasing out of third-party cookies, advertisers are seeking alternatives to collect consumer data ethically and effectively. This is where Retail Media shines: retailers have access to detailed data on their customers, including purchase history, browsing patterns and product preferences. This wealth of information allows for more precise segmentation and the creation of personalized messages.

Increased emphasis on ROI due to measurability

In an economic environment where every euro of advertising spend counts, brands are seeking channels that offer tangible results. Incorporating ads onto their own platforms is a natural evolution of the business model for retailers. This allows them to offer greater visibility to brands and leverage their own data to design highly targeted and effective campaigns.

Currently, they are implementing different approaches to monetise their data and advertising spaces. These include on-site advertising (within their websites and apps) and off-site advertising (using their information for ads on external platforms). These strategies not only maximize the impact of campaigns but also diversify revenue streams, positioning Retail Media as a key component of their value proposition.

Technological advancements in marketing and AI

The use of advanced technologies, such as artificial intelligence and marketing automation, is transforming Retail Media by enhancing personalization and improving campaign efficiency.

These tools allow for more precise audience segmentation, creating advertising experiences that are more seamless and less intrusive for consumers. As a result, both customer satisfaction and the overall effectiveness of campaigns increase, consolidating technology as a fundamental pillar in the development of Retail Media.

The cord-cutting phenomenon

Cord-cutting is the trend of abandoning traditional or linear television in favour of on-demand content, particularly prevalent among Millennials and Generation Z. And it has led to a decrease in the effectiveness and reach of conventional television advertising, as seen in the chart at the beginning of the article.

Due to the increase in digital content consumption and streaming, brands are exploring new platforms and methods to reach consumers through their ads. Retail Media offers a highly effective solution, as we will explain below.

Emerging Formats Redefining Retail Advertising

Retail Media is not only expanding in reach but is also adopting innovative formats that redefine how brands interact with their audiences. These formats are designed to leverage new technologies and emerging platforms.

Connected TV (CTV)

As we have introduced throughout this article, Connected TV is changing the rules of the game in advertising, offering the perfect combination of the reach of traditional television and the precision of digital marketing.

The figures support this trend. Linear TV advertising spend in the US peaked in 2018 at $72.8 billion. It has since declined, standing at $59 billion in 2024. While there is still room for linear television, its relevance is concentrated on specific programming that viewers prefer to watch live (such as news or sporting events) and not on demand.

Note: Includes digital (desktop/laptop, mobile and other internet-connected devices), directories, magazines, newspapers, outdoor, radio and television.

Source: Emarketer, March 2024

As linear television loses ground, Connected TV is gaining prominence. This format offers innovative opportunities for targeted advertising, personalised content and interactivity, features that would have surprised advertisers of the past.

CTV ad spending is projected to grow rapidly, surpassing many traditional channels. Although much of this increase is due to the migration of conventional television audiences to digital video, the shift is not just a matter of volume, but also of quality. CTV ads allow for audience segmentation based on purchase and behavioural data, making them an ideal option for retailers seeking to increase their visibility.

Audiences are also ready for this change.

Today, video is, by far, the preferred medium for younger generations. A recent Kenshoo Skai survey of 1,000 US adults explored whether Connected TV consumers would be willing to interact with ads on Prime Video. The responses were surprisingly positive:

- 86.5% of respondents would be willing to watch a short product video on Prime, similar to those already appearing on Amazon product pages.

- 89% would appreciate adding the product to their Amazon wish list with a single click.

- A remarkable 90% of respondents would be open to checking the price and learning more about the product.

- And finally, 78.5% would consider buying the product at that moment with a single click.

CTV’s hyper-personalized approach has proven effective at generating both brand awareness and instant conversions.

Audio Retail Media

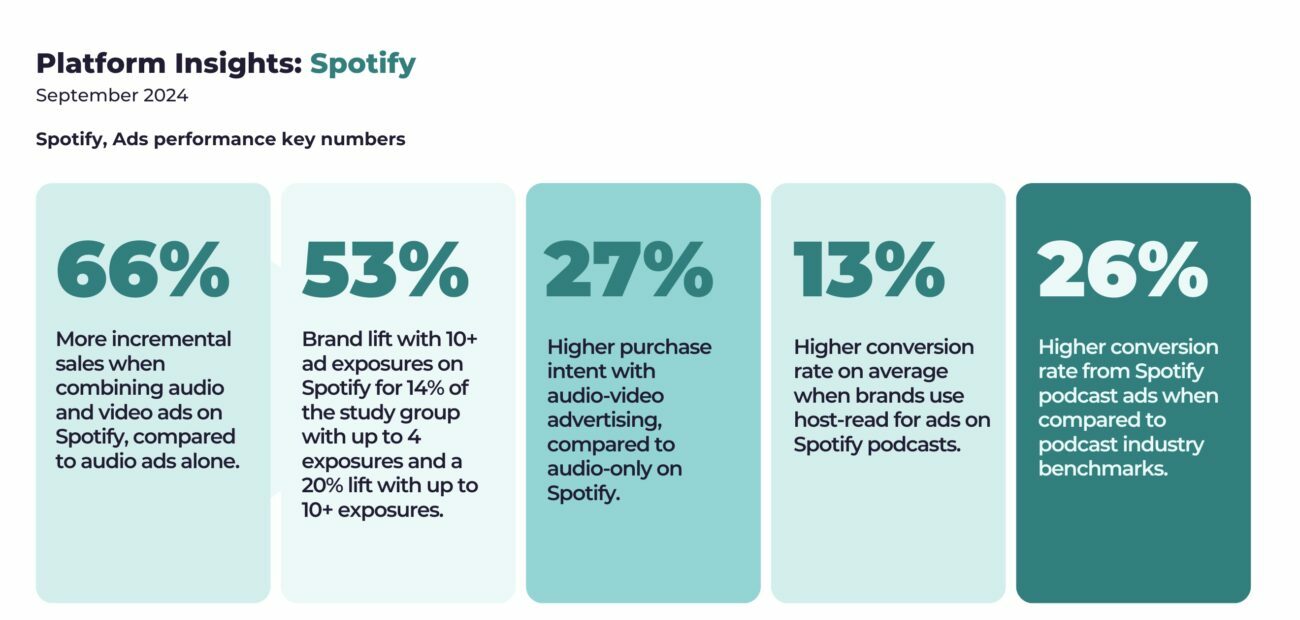

The rise of audio streaming services such as Spotify and Apple Music has opened up new opportunities for Retail Media in this format. Personalized ads can be inserted into playlists or podcasts, directing listeners to exclusive promotions or new products.

As extracted from a recent WARC study, global advertising revenue for Spotify is predicted to reach $2.1 billion in 2024, a 13% increase year-on-year. This revenue is expected to continue increasing in the following years, reaching more than $2.5 billion in 2026.

Below is a summary of the insights extracted from the report:

Note: Data extracted from Spotify’s advertising resources page

Source: WARC, 2024

An interesting example is the use of audio ads to promote offers in supermarkets. A consumer listening to an ad about discounts at a nearby retailer could be directed via a link or promotional code, creating an integrated shopping experience.

Monetising the physical world

Physical stores remain an important channel for advertising. This has been particularly reinforced by the incorporation of technologies such as electronic shelf labels and dynamic digital signage. These tools allow personalized messages to be displayed based on real-time data.

For example, a supermarket could display specific offers on digital screens located in the aisles, highlighting products that are popular among customers with similar profiles. At the end of 2023, the supermarket chain Tesco quadrupled the size of its in-store digital screen network. This action greatly expanded its ability to carry out In-Store Retail Media campaigns. These screens are programmed to display animated visual content, in-store advertising campaigns and the launch of exclusive products.

In the words of Ashwin Prasad, Tesco’s CCO, “Thanks to the unparalleled insights we obtain with our Retail Media data we can offer our customers advertising that interests them and, at the same time, give our suppliers the opportunity to showcase their products in a creative and innovative way.”

Shoppable ads

Shoppable ads are interactive ads that allow consumers to make purchases directly from the advertisement. This format is gaining ground on platforms such as Instagram, YouTube and TikTok, where users can view a product, obtain more information and add it to their basket without leaving the platform.

A recent example is the use of video ads that allow users to swipe up to directly purchase a promoted item. These formats are especially popular among younger audiences, who seek quick and frictionless shopping experiences.

The Future of Retail Media: Challenges and Opportunities That Will Define its Evolution

Despite its advancements, Retail Media faces significant challenges that will determine its trajectory in the coming years. At the same time, the opportunities for growth and diversification are enormous.

Multichannel integration

One of the biggest challenges for Retail Media is the effective integration of multiple channels. Consumers interact with brands through a variety of touch points: online, on mobile devices, in physical stores and through third-party platforms. To succeed, brands must develop strategies that seamlessly connect these channels, ensuring a consistent omnichannel experience for the consumer.

This requires investment in technology platforms that can centralize data, cross-reference it with information from the Digital Shelf and the global market, and also measure the impact of each interaction on the customer journey. Flipflow allows you to do all this in real time, and it also provides a complete view of what your competitors are doing, so you don’t miss any market movements.

The integration offers brands a complete overview of how their products are presented and perform across all channels. It also optimizes promotional and positioning strategies. This detailed analytical capability will allow not only for an improved shopping experience but also for increased competitiveness and profitability.

Strategic partnerships

Another crucial area for the growth of Retail Media is the creation of strategic partnerships. Retailers are collaborating with technology providers, market analysis platforms such as flipflow and other key players to build ecosystems that offer value to both brands and consumers.

For example, our Retail Media Data Analysis tool not only allows you to centralize and simplify the analysis of your campaigns, but it also gives you the ability to make more informed, data-driven decisions in real time. Whether you are looking to improve your ROI, optimize ad performance or simply make your team work more efficiently, a strategic partnership with us will help you achieve your business goals faster and more effectively.

Final Thoughts and Growth Prospects

Retail Media is undergoing a period of accelerated transformation. Its ability to connect brands with consumers at key moments in the purchase process positions it as an indispensable tool in modern marketing. However, to unlock its full potential, both retailers and advertisers must overcome challenges such as data integration, competition for advertising space and the growing expectations of consumers.

Ultimately, the future of Retail Media will be defined by its ability to adapt to a constantly changing landscape. With technological innovation and strategic collaboration as cornerstones, this industry has the potential to significantly reinvent advertising, benefiting both brands and consumers.