The Digital Dairy Market in Mexico: Strategies, Competition and Trends

The dairy market in Mexico has evolved significantly in recent decades. It has been influenced by changes in consumption habits, Mexicans’ concern about their health and advancements in food technology. Milk, historically the most popular dairy product in the country, has experienced a slight decline in demand. However, other products such as cheese, sour cream and butter have gained prominence. This shift in preferences, coupled with the dependence on imports for certain dairy products, has led the industry to adapt and diversify to remain competitive.

Despite being a vital sector for the Mexican economy, with a contribution of 9% to the food industry’s GDP in 2021, domestic production faces challenges against competition from imported products. These products often have more affordable prices, prompting local producers to improve their quality standards and explore new value-added alternatives.

With the projected increase in demand for some products and the trend towards healthier and sustainable options, the digital dairy market in Mexico has seen significant growth in recent years, driven by increased digital consumption and improvements in food delivery and storage systems.

In this article, we will explore how the main brands —Lala, Alpura, Danone and Santa Clara— are leveraging e-commerce to position themselves in this market, thanks to the use of digital visibility strategies, promotions and adaptation to the different geographic areas of the country. The analysis, conducted with data extracted from our market analysis platform, reveals not only the performance of each brand, but also consumer preferences and growth opportunities in this dynamic market.

Geographic Distribution of Dairy Products and Store Presence

The brands’ strategies vary depending on the different supermarket chains and Nielsen regions of the country.

In terms of supermarkets:

- Walmart and Chedraui maintain high stock levels, with 100% availability across several brands during the quarter. This reflects the reliability of these stores to ensure a continuous supply of products.

- Walmart also stands out for the variety of product assortments it offers. Its average assortment in the third quarter of 2024 was 787 products from the 4 brands analyzed. The next competitor, Bodega Aurrera, came in at 651 products. This data is crucial for brands, because shelf presence on digital shelves directly influences consumer purchase decisions.

- On the contrary, Sam’s and Soriana supermarkets present challenges for some brands, the former in terms of assortment and the latter in terms of stock ratio. Sam’s average assortment in terms of dairy products from these brands is 96 products, 8 times lower than the average assortment of Walmart. Regarding Soriana, none of the brands analyzed reached an 80% average stock ratio, which suggests an opportunity for improvement in inventory management at this chain.

On the other hand, we have analyzed the geographic distribution of brands in the Nielsen Areas of the country. Alpura stands out in most areas, especially in central Mexico (area 4). Lala stands out in areas 1 and 2 (north and northeast of the country), while Santa Clara and Danone have a smaller share in terms of geographic distribution, focusing on specific areas where they are more competitive.

Price Analysis

Price is another key element in each brand’s strategy. In the study, where we have analyzed the average in-store price per keyword for these products (for example, “lactose-free milk” or “natural yogurt”), we observe significant price variability between categories and brands:

Sour Cream

Alpura offers the most expensive sour creams, despite its strong presence in the Top 10 and 50 search results. This would be indicative that consumers are willing to pay more for their products in this category.

Milk

In terms of milk, the 3 brands have very different prices, despite being more or less evenly matched in Share of Shelf. This price disparity could be due to brands marketing milk in a wide variety of formats. It could be that in one store, products for a given keyword are sold in a more expensive format (for example, in a 6-pack of bricks) than in other stores.

Cheese

Santa Clara sells some of the most expensive cheeses, although it has a smaller offering. This suggests a strategy focused on an audience willing to pay more for these specific products.

Yoghurt

Despite its dominance in Share of Shelf, Danone doesn’t compete with the lowest prices on yoghurt, maintaining a higher price than Alpura but slightly lower than Lala.

In terms of regional prices, they vary significantly. For example, lactose-free milk tends to be more expensive in the north of the country (area 2) and cheaper in the southeast (area 6). On the other hand, Greek yoghurt is more expensive in the Bajío (area 3) and cheaper in central Mexico (area 4). This variability by geographic area offers opportunities for brands to adjust their pricing and promotional strategies according to the competitiveness of the local market.

Stock and Promotions: Strategies and Differences

The four brands show a trend towards reducing their promotions throughout the quarter, possibly to prioritize profitability over market share acquisition through discounts. However, Lala stands out for having the highest number of active promotions, almost doubling Alpura’s effort in this regard. This aggressive approach to promotions could explain some of its success in Share of Shelf and available assortment.

Stock management also reflects some opportunities. Although Lala, Alpura and Danone maintain stock availability above 90% in most stores, Santa Clara is experiencing challenges in this regard, suggesting areas for improvement for this brand in terms of availability in certain key retailers.

Competition in the Digital Dairy Market

In the analysis carried out, Lala stands out as the leading brand, both in product variety and online presence. It not only surpasses its competitors in most categories, but it also maintains a consistent assortment in almost all the supermarket chains evaluated. Alpura, on the other hand, remains a strong competitor, with an outstanding offering in milk and cream. While Danone and Santa Clara opt for a niche strategy.

To better understand this competition, it is very useful to analyze the Digital Share of Shelf for each category separately.

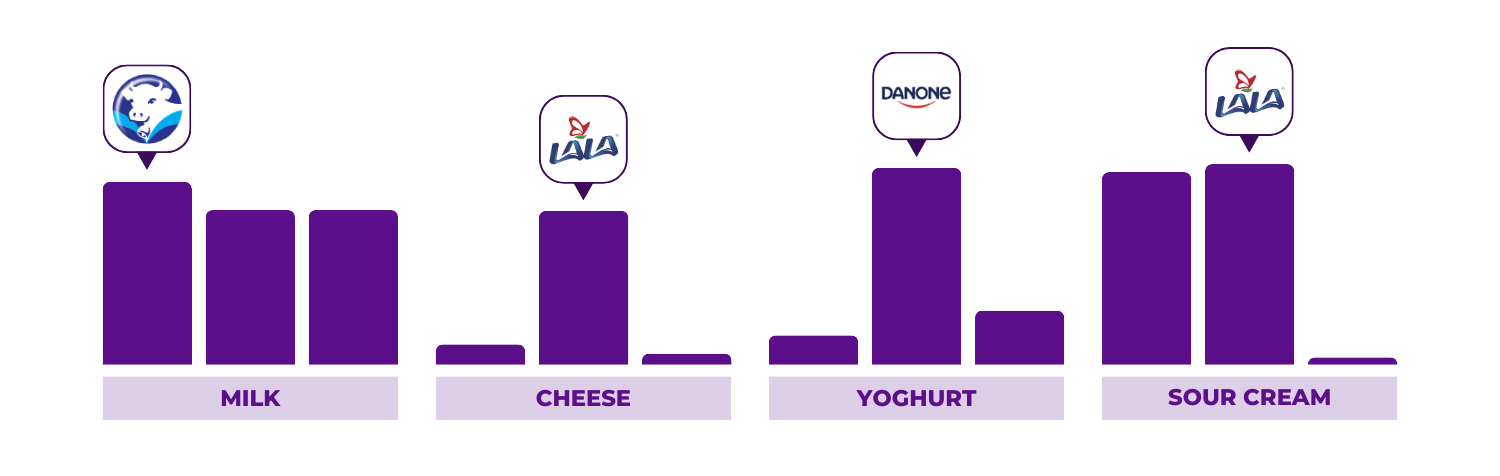

Digital Share of Shelf by Dairy Product Categories

In the digital market, Share of Shelf reflects the proportion of visibility a brand has on virtual shelves or in the search results of online platforms. This indicator is fundamental for understanding how accessible and attractive products are to consumers looking for dairy products online. According to the study, each of the main brands adopts different strategies based on their strengths in specific categories:

Milk

In the milk category, our analysis reveals that Lala and Alpura dominate in terms of visibility and frequency of appearance in the Top 3 and Top 10 of search results, demonstrating strong competition in this fundamental category. On the other hand, Santa Clara manages to position itself in specific niches, such as UHT milk. For this keyword, it achieves good visibility levels, although overall its presence is less than that of Lala and Alpura.

Yoghurt

In the yoghurt category, Danone stands out as the absolute leader in Digital Share of Shelf. It surpasses its competitors at all levels (Top 3, Top 10 and Top 50) consistently. In fact, Danone’s SoSD in the Top 10 reaches over 50%, reflecting a focused and effective strategy in this category. Lala and Alpura are also present in the yoghurt category, but they lag behind compared to Danone’s visibility. This dominant position of Danone is a reflection of its specialization in yoghurt products, which allows it to connect with consumers who are looking for a wide and varied offering in this segment.

Cheese

In the cheese category, Lala positions itself as the dominant brand, especially in the subcategories of panela cheese and manchego cheese. Lala appears prominently in the Top 3 search results, which suggests a strong visibility strategy in this segment. Santa Clara and Alpura have a more limited presence in cheese. This is mainly because Alpura markets this category under a sub-brand (Carranco), while Santa Clara has a more limited assortment in cheese products, only with cream cheese and cottage cheese. However, Santa Clara manages to gain some visibility share in cottage cheese, indicating a niche market that it has successfully entered.

Sour Cream

The sour cream category presents a close competition between Lala and Alpura, who compete at almost the same level in digital visibility. Lala has a slight advantage in the Top 3 search results, while Alpura dominates the Top 10 and Top 50. This indicates that Alpura has positioned itself as a significant option in the sour cream market despite its generally higher prices. Santa Clara, on the other hand, appears in the Share of Shelf for this category with a lower percentage, highlighting once again in more specific market niches.

Conclusions and Recommendations for the Digital Dairy Market in Mexico

Our study on the digital dairy market in Mexico provides a clear perspective on the strategies of major brands and consumer behaviour. Several recommendations emerge from the results obtained:

- Optimize presence in key areas and chains: To improve its competitiveness, brands such as Santa Clara should focus on ensuring greater stock availability in stores with less coverage, such as Soriana, and leverage the high coverage of Walmart and Chedraui to consolidate themselves in those chains.

- Expand product and promotional segmentation: Lala has shown that a consistent promotional strategy can strengthen digital visibility and assortment, while Alpura could increase its promotional efforts in key categories such as sour cream to strengthen its position.

- Competitive and differentiated pricing strategy: To continue attracting consumers, it is important for each brand to adapt its pricing strategy. For example, Alpura can continue to leverage its premium sour cream offering, while Danone could benefit from adjusting its yoghurt price to compete more aggressively in the more affordable segments.

- Investment in visibility and keyword optimization: Digital Share of Shelf, for strategic keywords such as “milk” or “yoghurt”, is a crucial metric that helps improve brand perception among consumers. Lala and Danone lead in this area, but other brands could strengthen their presence through SEO strategies and better optimization of keywords on their e-commerce platforms.

In conclusion, the digital dairy market in Mexico is highly competitive. While Lala and Alpura stand out in most categories, Danone and Santa Clara continue to find room to differentiate themselves. Building on strengths and improving in key areas would allow each brand to reinforce its presence and capture a larger share of the market in the coming quarters.