Competitive Intelligence: Analysing Your Competitors Beyond Price

In an increasingly competitive business environment, the traditional strategy of competing solely on price has become unsustainable. Slowing inflation and evolving consumer expectations have led businesses to seek new ways to differentiate themselves and maintain their competitive advantage. According to PriceBeam, in 2025, pricing teams will need to adopt a holistic approach to pricing, considering not only the individual price of products but also the customer journey and other additional services.

Price wars, while attractive in the short term, can trigger a spiral of discounts that erode profit margins and destabilize the industry. Instead, businesses are opting for strategies that prioritize perceived value, innovation and customer experience. These approaches not only allow for fairer and more sustainable pricing but also strengthen customer loyalty and brand identity.

In this context, competitive analysis must go beyond simple price comparison to encompass factors such as value proposition, marketing strategy or differentiation by attributes. Businesses that integrate these strategies will be better positioned to thrive in the market.

In this article, we will explore how to conduct a more in-depth and effective competitor analysis, without focusing exclusively on price. We will also address why price is no longer the only decisive factor in competition and the risks of basing differentiation solely on cost-cutting strategies.

How to Conduct a Competitor Analysis?

As we explained in a previous post, competitor analysis is a structured method for gathering valuable information about your business operations. Its objective is to provide the data you need to compare your operations with those of the competition, identify opportunities to differentiate yourself and position yourself more effectively.

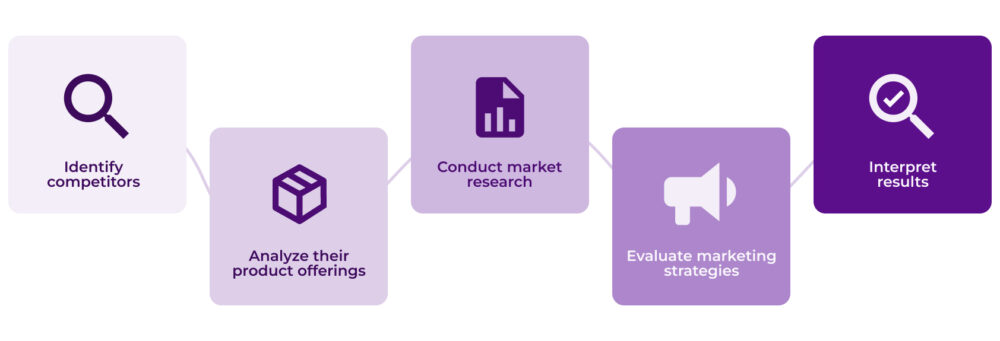

But, what are the steps needed to conduct a competitor analysis? We explain the process:

1. Identify your competitors

Before analysing your competitors, it’s crucial to identify them correctly. They can be classified into three types:

- Direct: Businesses that offer similar products or services and that target the same customer base.

- Indirect: Those that, although they don’t offer exactly the same thing, can satisfy the same customer need.

- Potential: New businesses or brands that could enter the market and represent a threat.

To identify these competitors, tools such as Google Trends, keyword analysis in Ahrefs or real-time data analysis platforms such as flipflow can be used.

2. Understand their product offering

Detailed analysis of competitors’ product offerings is essential to identify opportunities for improvement and differentiation in the market. To conduct this analysis, it’s important to evaluate aspects of the offering that go beyond the individual characteristics of each product:

- Key features and differentiators: This includes not only the technical characteristics of the product but also design elements, user experience and any factor that makes consumers perceive a unique value in the competitor’s offering.

- Frequent promotions and discounts: Studying how the competition uses these tactics allows you to understand what type of incentives they are offering and how these impact purchasing decisions.

- Presentation strategies: How products are packaged and presented plays a decisive role in consumer perception. This includes how the benefits are communicated through the packaging, labels and descriptions.

Understanding these factors also allows you to identify vulnerabilities and areas where you can improve or innovate.

3. Analyse the market

Once you have identified the key competitors and understood their product offerings, the next step in competitive analysis is to conduct more in-depth market research. This analysis will help you better understand industry trends, demand dynamics and external factors that may influence the competition. Market research is divided into two types:

- Primary research: Obtaining data directly from the source, either through competitors’ products or services or through interaction with their customers. This type of research is particularly useful because it provides fresh, direct and relevant information. The main primary research tools include customer interviews, product testing or online surveys.

- Secondary research: This is based on the analysis of information that has already been collected and published previously. This information can be found in various sources such as industry reports, previous market studies, news articles and competitor analyses available online.

To conduct a thorough market analysis, it is advisable to combine both forms of research. This will enable you to obtain a more complete and accurate picture of your competitive position in the market.

4. Review your competitors’ marketing strategies

Observing how competitors communicate can provide key information about their positioning and differentiation. Some aspects to evaluate include:

- Social media presence and engagement: Analyze which platforms your competitors are active on and how they interact with their audience.

- Investment in digital and traditional advertising: Examine the advertising channels they use, both digital and traditional, and how they allocate their budget among them.

- Brand content and storytelling: Observe the type of content they generate and how they tell their brand story.

Analysing these aspects is crucial for identifying opportunities that can help you improve your own marketing strategy and differentiate yourself in the market.

5. Interpret the results and identify your place in the market

Once the data has been collected, it is important to interpret it and use it to identify opportunities to exploit, define your own strategy and understand your current and future position in relation to other businesses. This should be based on key questions that guide the development of your action plan. Some of these questions include:

- What are my business’s strengths and weaknesses compared to the competition? Fundamental for having a clear view of your position against your competitors and identifying areas where you can improve and leverage your strengths.

- What differentiation opportunities can I leverage? Opportunities can arise from various areas, such as personalising your products or services, using innovative technologies or even exploiting market niches that your competitors are not adequately covering. Differentiation will allow you to build a loyal customer base that values the unique characteristics of your offering.

- What threats could affect my market position? Identifying threats is essential for developing mitigation strategies that protect your business.

Once these questions have been answered, you should be able to carry out a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to help you clearly define your place in the market. This step is crucial because it provides a solid foundation upon which you can build short, medium and long-term strategies. By identifying areas for improvement, opportunities and threats, you can make more informed decisions about how to position yourself and grow sustainably in your sector.

Why Price No Longer Defines Competition

Price has traditionally been a decisive factor in competition between brands. However, changes in consumer behaviour and market evolution have reduced its relevance as the sole differentiator.

Businesses that only compete on price risk losing market share where customer loyalty is based on other key factors such as quality, service and overall experience. In fact, a Microsoft study indicates that 81% of consumers are willing to pay more for a better customer experience.

The new consumer reality

The modern consumer has drastically changed their habits and priorities. Beyond seeking low prices, they now value aspects such as personalized experience, quality and innovation. Many people prefer to buy products from committed companies, opt for brands that offer them recommendations tailored to their needs and are willing to pay more if this guarantees durability and good after-sales service. In addition, technology and innovation play a key role in purchasing decisions, as consumers seek products that offer advanced features and disruptive solutions.

This shift in behaviour means that businesses that rely solely on low prices to attract customers are at a disadvantage. True differentiation lies in product quality, user experience and emotional connection with the brand.

The Risks of Basing Differentiation Solely on Price

Accelerated Commodification

If a business only competes on price, it risks turning its product into a “commodity”, losing perceived value and reducing its ability to build customer loyalty. Companies like Xiaomi have demonstrated that combining competitive pricing with constant innovation is a more effective strategy.

Brand Erosion

When brands rely excessively on discounts and low prices, their image can be affected, conveying a perception of lower quality or reducing their exclusivity. Luxury brands such as Louis Vuitton have maintained their prestige by avoiding aggressive discounting strategies, which has allowed them to retain their perceived value and customer loyalty.

Strategic Myopia

Focusing only on price prevents the identification of innovation opportunities in customer experience, after-sales service and other value-added factors. Differentiation through customer service is a key strategy used by brands such as Zappos, leading them to achieve excellent results.

Pressure on Margins

Cutting prices to compete can lead to an unsustainable price war, eroding profit margins and limiting the ability to reinvest in the business. According to the Harvard Business Review, companies with aggressive pricing strategies can face dangerously low operating margins.

Differentiation Beyond Price: The Use of Competitive Intelligence

Competitive intelligence is the process of collecting, analysing and applying relevant information about the competition and the market environment to make well-founded strategic decisions. It is a proactive approach that enables businesses to anticipate industry changes and react in an agile and effective manner.

To compete effectively without resorting to price wars, it is fundamental to adopt competitive intelligence strategies. This includes:

- Innovation in products and services: Companies such as Apple have demonstrated that innovation can justify premium prices.

- Customer experience: As previously mentioned, the vast majority of consumers consider customer experience a key factor in loyalty.

- Personalisation: Major brands have been able to increase loyalty through product personalization options.

- Added value: Offering additional services, extended warranties or loyalty programmes.

Simple price competition ceases to be a sustainable strategy when all brands can match discounts and offers. In this scenario, the real difference emerges by deciphering the strategic layers of the competition: from their value narrative to their emotional connection with the public. Organisations that go beyond superficial comparison build unique propositions where operational excellence, anticipation of trends and the creation of memorable experiences become new competitive pillars.

This holistic approach, supported by the real-time data that our market analysis platform can provide, and a deep understanding of the industry ecosystem, will enable businesses to not only occupy market spaces but to define them. A sustainable advantage is no longer gained in price wars but in the ability to evolve through applied intelligence, transforming insights into tangible innovations that resonate with current demands for quality and authenticity.