Competitive Analysis for Retailers: What You Should Measure and Why It Matters

In 2025, with competition intensifying daily and consumer expectations evolving alongside technology, competitive analysis is becoming an essential tool for leading retailers in fast-moving consumer goods.

A detailed understanding of market behaviour, competitor strategies and emerging trends is a necessity for survival and prosperity in this environment. In this post, we will explore why competitive analysis is vital for large Fast-Moving Consumer Goods (FMCG) chains, what aspects they should measure and why each of these indicators can make all the difference in their overall strategy.

Throughout the text, you will discover how competitor analysis can be transformed into a sustainable competitive advantage, enabling changes in the market to be anticipated, operations to be optimized and, ultimately, business profitability to be increased.

Introduction: The New Competitive Retail Landscape

The retail sector has undergone unprecedented transformations in recent years. Factors such as digitalisation, the rise of e-commerce and omnichannel strategies have redefined the relationship between brands and consumers. This situation requires retailers to evolve their strategies, incorporating data analysis tools and advanced technology to better understand the market, consumer behaviour and anticipate competitor movements.

Despite persistent challenges, there are promising opportunities. Bain & Company projections suggest that, barring significant macroeconomic or geopolitical changes, US retail sales will increase by 4% year-on-year in 2025, in line with the actual growth seen in 2023 and 2024.

Today’s retail sector has evolved into a hybrid model where the physical and digital coexist. Globally, 59% of consumers prefer to shop online, while 41% still opt for the in-store experience. However, this balance varies significantly between generations. Baby boomers are the only group where a majority (58%) prefer to shop in-store, although this doesn’t mean that physical commerce is irrelevant to younger people. Over 40% of Generation Z say they prefer the in-person experience over online shopping, a figure that has remained stable since 2020.

FMCG brands must face an environment where customers seek quality products as well as comprehensive and personalized experiences. And a landscape marked by economic volatility, constant regulatory changes and other complexities that redefine the rules of the game.

Why competitive analysis is vital for retailers?

When we talk about large FMCG chains, we are referring to organisations that handle a wide variety of fast-moving consumer products, operate in multiple markets and have a complex organisational structure.

In this scenario, competitive analysis becomes vital for various reasons:

- Market anticipation: Rigorous analysis allows for changes in consumption to be foreseen and for the offering and marketing strategies to be adjusted before they become widespread trends.

- Margin optimization: With detailed information on competitor pricing, retailers can intelligently adjust their margins, maintaining profitability and competitiveness.

- Experience innovation: Data analysis helps improve the customer experience through personalization and new technologies at the point of sale.

- Operational efficiency: Detecting inefficiencies in the supply chain allows processes to be optimized and logistical crises to be anticipated.

- Differentiated strategies: Understanding competitor movements facilitates the development of unique strategies adapted to each market.

Success stories such as that of Walmart illustrate the transformative power of competitive analysis: This company, one of the world’s largest retail chains, constantly monitors its competitors’ pricing strategies, product assortments, supply chain efficiency and customer service initiatives. This vigilance has enabled them to identify and capitalize on market opportunities. For example, Walmart analyzed its competitors’ product assortments and identified opportunities to adapt its offering to specific local markets. This approach ensures that each store responds to the unique preferences of its local customers, thus increasing their satisfaction and loyalty.

In short, competitor analysis becomes the guiding light for retailers in a highly competitive environment. It allows data to be transformed into strategic and tactical decisions that enhance adaptability and operational agility.

5 Strategic Proposals on What You Should Measure and Why It Matters

To achieve robust competitive analysis applicable to today’s retail reality, it is fundamental to identify and monitor key indicators. Below, we present five strategic proposals that can make all the difference in competitive management for FMCG chains:

1. Controlling the global territory without losing local agility

In a globalized world, these retailers must have a comprehensive vision of their operations globally, without neglecting the need to adapt to the particularities of each local market.

To do this, it is key to measure market share in different regions. This identifies growth opportunities, adjusts offerings according to local preferences and detects emerging trends that may influence demand. Furthermore, evaluating the effectiveness of local campaigns compared to global performance allows for the optimization of commercial strategies and ensures that each market receives a relevant value proposition.

By controlling these aspects, retailers can maintain overall consistency in their strategy while demonstrating considerable flexibility to adapt to the demands and particularities of each region.

2. Defending margins in the invisible price war

Price wars are one of the most constant challenges in the retail world. With the emergence of new competitors and easy access to information, profit margins are under constant pressure.

To remain competitive without compromising margins, retailers will need to monitor prices in real time, both in physical stores and online platforms, and analyze consumer sensitivity to price changes. Comparing promotions and discounts with those of the competition helps to identify effective tactics and adjust your own strategy to maximize impact. Using this data, dynamic pricing strategies can be implemented that balance profitability and sales volume.

Defending profit margins will protect profitability and reinforce brand image, thus demonstrating a firm and well-founded position in the market.

3. Turning own-brand products into profit-driving weapons

Own-brand products have gained prominence in the FMCG sector as an attractive alternative for both the retailer and the consumer. These brands, being internally managed, offer higher margins and greater loyalty if correctly positioned.

To enhance their impact, it is necessary to measure consumer perception and reinforce attributes such as quality or price-value relationship. Profitability should also be analyzed in comparison with leading brands to identify competitive advantages. Monitoring the competition’s strategy in this segment allows for the development of differentiated value propositions. On the other hand, product innovation ensures that the offering remains attractive and aligned with market trends.

Turning own-brand products into true profit-driving weapons involves a comprehensive approach that combines continuous improvement of the offering with a robust marketing strategy and good resource management.

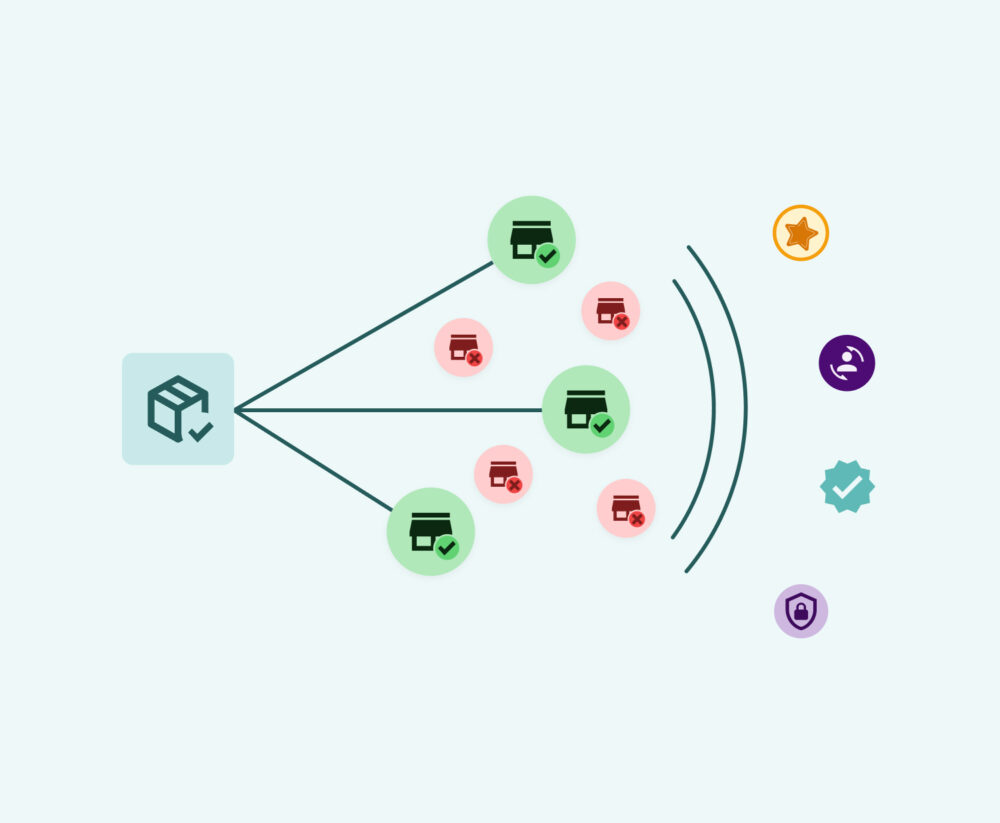

4. Anticipating supply chain crises with 360° intelligence

The supply chain is the fundamental link in the operation of any retailer. Efficient management of inventories and logistics is essential for avoiding stockouts and ensuring a satisfactory shopping experience.

Implementing real-time monitoring systems allows for problems to be detected before they affect product availability. Using predictive analysis models helps to anticipate fluctuations in demand and adjust supply accordingly. Evaluating supplier stability and having contingency plans reduces vulnerability to external crises.

Finally, integrating data from different sources, such as logistics, sales and customer feedback, on a single platform provides a comprehensive overview to optimize inventory management, improve operational efficiency and strengthen the retailer’s competitive position.

5. Creating experiences that competitors can’t copy

In a market where products and prices are increasingly homogenous, customer experience becomes a decisive factor. Measuring consumer satisfaction through surveys and data analysis allows for areas for improvement to be identified. Evaluating how customers interact with the brand across different channels (physical store, online, mobile) helps design seamless and personalized experiences. Innovating at the point of sale, incorporating new technologies and shopping formats, strengthens differentiation. Furthermore, personalizing the offering based on consumer behaviour improves loyalty and increases customer lifetime value.

To create experiences that are truly difficult to replicate, retailers must combine data derived from competitive analysis with deep insights about their own customers. This requires a customer-centric approach and constant investment in technology, training and data analysis. This is a long-term commitment that can consolidate the brand’s market position and generate lasting relationships with consumers.

Why Competitive Analysis is Urgent for Large Retailers?

The rapid pace of change in the retail sector doesn’t allow for complacency or delayed reactions. Large retailers, despite their resources and scale, face particular challenges that make it imperative to develop advanced competitive analysis capabilities:

- Risk of obsolescence: The speed at which trends and technologies evolve means that today’s strategies can become obsolete in a matter of months.

- Constantly evolving global competition: Large chains no longer compete solely at a local level. With globalization, retailers must face international competitors bringing new ideas, disruptive business models and aggressive strategies.

- Pressure on profit margins: Lack of precise data on competitor behaviour can erode profit margins, affecting profitability and long-term sustainability.

- Need for rapid adaptation: Market volatility requires agile responsiveness. Only through competitive analysis is it possible to anticipate changes and adjust strategy in a timely manner.

- Customer loyalty and differentiation: Analyzing competitor actions and reactions is fundamental to designing unique value propositions that consolidate consumer loyalty.

The urgency of implementing robust competitive analysis therefore lies in the ability to transform data into action. These actions must be specific to ensure the relevance and success of the chain. In a context where time is a resource as valuable as any other, having precise and up-to-date information allows changes to be anticipated and informed strategic decisions to be made.

Conclusion: From Data to Action

Transforming competitive analysis into concrete actions that generate value represents the real challenge for contemporary retailers. Having exhaustive competitive data is only the first step; the real value emerges when this information translates into strategic and operational decisions that improve competitive positioning and profitability.

To effectively evolve from data to action, organisations must develop systematic processes that connect the findings of competitive analysis with decision-making mechanisms. This requires establishing a “competitive intelligence cycle” where the continuous collection of data is integrated with periodic analysis, strategic distribution of insights and monitoring of resulting actions. This structured approach ensures that investments in competitive analysis generate tangible returns.

The democratisation of competitive insights within the organisation is another critical factor in maximizing its impact. The most advanced retailers are implementing dashboards and visualization tools that make competitive intelligence accessible at different organizational levels, from executives to store managers. This accessibility ensures that both everyday decisions and major strategic bets are informed by up-to-date competitive understanding.

In a scenario where the only constant is rapid change, competitive analysis represents a fundamental strategic investment. Retailers who systematically transform competitive data into strategic actions will be positioned to not only survive but thrive in the demanding competitive landscape of 2025 and beyond.