Global List of Retail Media Networks

The Retail Media market is growing non-stop, as we have discussed in previous articles. Global spending on Retail Media advertising is on track to increase by almost $100 billion between 2020 and 2025. According to eMarketer’s prediction, it will increase by 21.8% in 2024, making it surpass growth rates for almost all other advertising spending platforms.

Due to this exponential growth, brands and agencies are finding it increasingly difficult to navigate the Retail Media network landscape and find the one that best suits their needs.

What you will find in this list

In the table below, you will find a list of over 200 Retail Media networks that are currently known, with data obtained publicly, to guide you on which ones exist, in which countries they operate and what technologies they use.

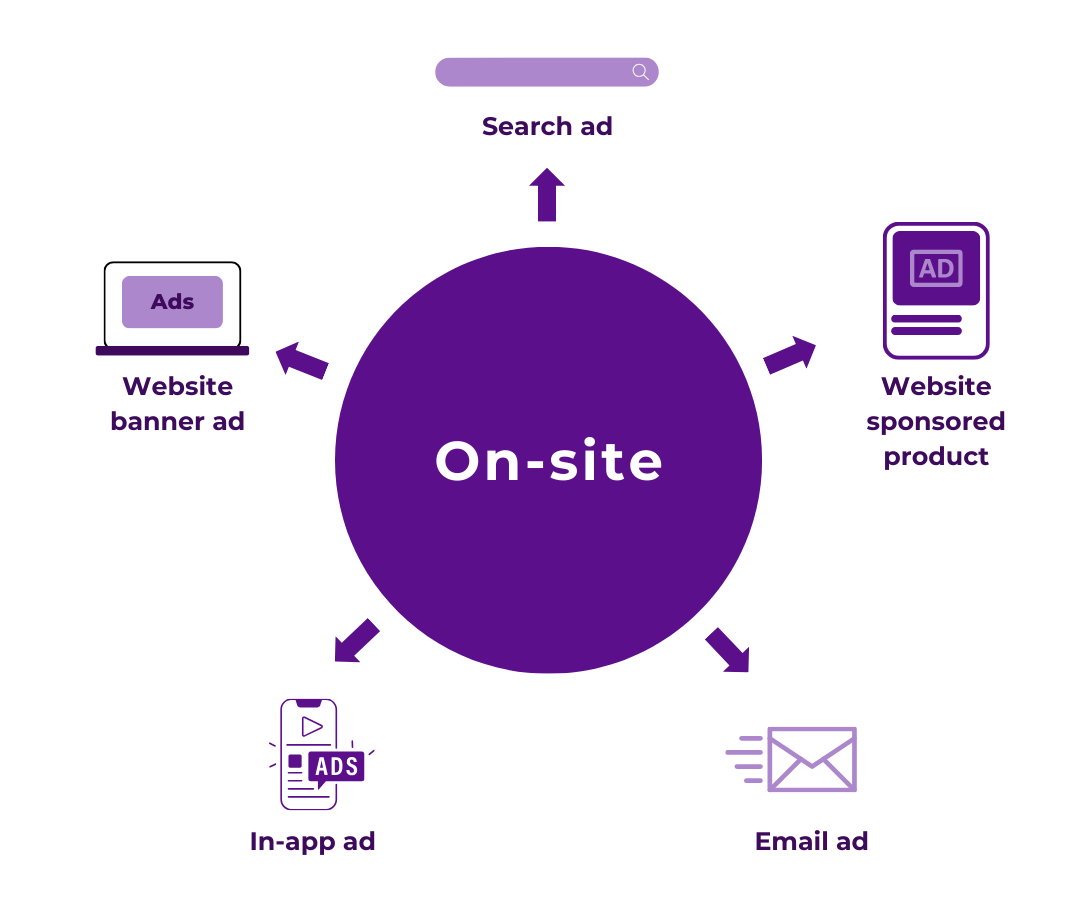

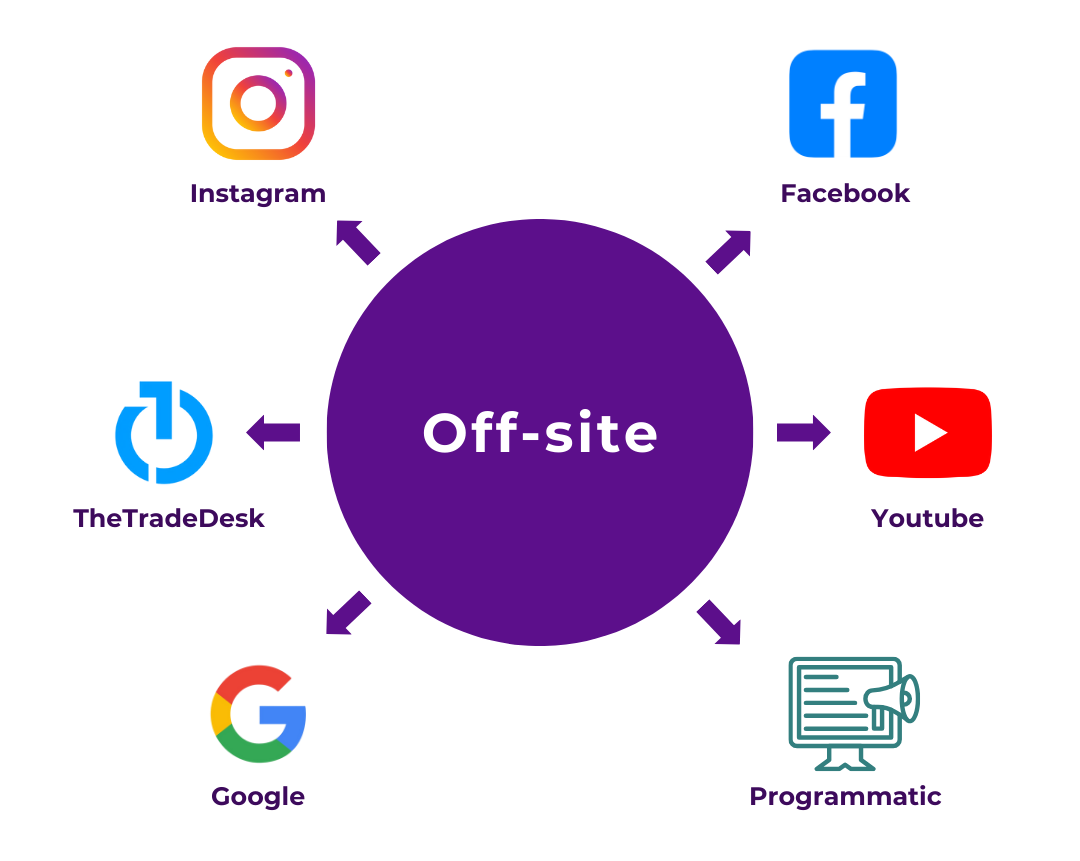

In line with this, we wanted to highlight the different types of ads that can be published on a Retail Media network and where they appear, as this will help us understand the technologies used by the different networks presented in the list.

On-site

These are the ads that appear within the retailer’s own platform:

Off-site

These are ads that are published on third-party networks:

In-store

These are ads that appear in physical stores:

What are the biggest Retail Media Networks today?

Currently, the largest Retail Media networks operate in the North American market, dominated by networks from giants like Amazon or Walmart. Amazon was the first player to open this market, creating its Retail Media network in 2012.

In 2023, Amazon captured around 75% of the $45 billion the US Retail Media advertising market moved. This is 10 times more than what the second player, Walmart Connect, took.

It is no surprise, therefore, that the rise of Retail Media Networks is known as the “Amazon effect”: all retailers are looking to get in on the game and take a piece of the pie from sales of advertising space in Retail Media.

In Europe, the market is more fragmented. Although Amazon is a strong contender on the European continent, local players can rival its strength. The clearest example is in supermarket chains such as Carrefour, which dominate the FMCG space.

Although at much lower levels than those of Amazon, according to Statista data, advertising revenue generated by Carrefour with its Retail Media network was around $64 million in 2021. These revenues are expected to increase significantly to reach 8 times higher in 2026, reaching $500 million.

2024 looks set to be the year of Retail Media’s boom in Latin America. Why? The economic uncertainty in certain countries in the region is pushing consumers to look for the best possible prices, promotions and discounts. And most are doing so on the digital channels of retailers, which increases the capitalisation of Retail Media that appears on these channels.

The biggest example is found in the retailer Mercado Libre, which in this region is beating Amazon at its own game. In 2023, this company’s Retail Media advertising revenues in Latin America reached $625 million, making it the leading Retail Media network in the region. Amazon’s operations in the two largest economies in Latin America (Mexico and Brazil) generated a combined estimated revenue of $237 million, almost 3 times less than the retailer from Latin America.

In the Asia-Pacific region, Retail Media networks are beginning to gain traction and, although they are currently moving at a slower pace than in other regions, the prediction is that they will increase exponentially by 2030.

How many RMNs are there currently?

Currently, around 220 Retail Media networks are known to exist. And this number keeps on increasing.

As we presented at the beginning of this article, these networks can be operated by retailers that only move in the online environment, by those that do so in stores or by both at the same time.

Furthermore, they can use different technologies for this purpose, created in-house for them or from providers such as Criteo or CitrusAd.

How global is the list? Which areas does the table cover?

The table includes networks operating in all areas of the world:

- EMEA (Europe, Middle East, Africa)

- NA (North America)

- LATAM (Latin America)

- APAC (Asia-Pacific)

However, it is difficult to obtain data on many of them, and therefore, the table focuses mainly on the North American and European markets, partially covering the rest of the regions.

It is interesting to monitor smaller markets, as they are sometimes dominated by retailers that may be unknown to global players and win some ground from them.

Complete list of Retail Media Networks

Source: Retail Media Networks List | Mimbi

What is flipflow’s role in the Retail Media industry?

Our market analytics platform includes a tool for monitoring your Retail Media campaigns in real time. Through the reports generated by the platform, you will be able to have data on specific position and appearances, for any type of ad, on any channel/category. On the other hand, your marketing and marketplace managers will be able to have valuable information to optimise advertising spend and brand visibility in the greatest detail. Not forgetting, that you will be able to analyse all this on your competitors as well, so you know exactly what they are doing in Retail Media.

Want to know more? Request a demo and discover everything that flipflow can offer you.